Intel Bleeds Red, Plans 15% Workforce Layoff and $10B Cuts For 2025

by Ryan Smith on August 1, 2024 7:15 PM EST

Amidst the backdrop of a weak quarterly earnings report that saw Intel lose money for the second quarter in a row, Intel today has announced that the company will be cutting costs by $10 billion in 2025 in an effort to bring Intel back to profitability. The cuts will touch almost every corner of the company in some fashion, with Intel planning to cut spending on R&D, marketing, administration, and capital expenditures. The most significant of these savings will come from a planned 15% reduction in force, which will see Intel lay off 15,000 employees over the next several months – thought to be one of Intel’s biggest layoffs ever.

In an email to Intel’s staff, which was simultaneously published to Intel’s website, company CEO Pat Gelsinger made the financial stakes clear: Intel is spending an unsustainable amount of money for their current revenues. Citing the company’s current costs, Gelsinger wrote that “our costs are too high, our margins are too low,“ and that “our annual revenue in 2020 was about $24 billion higher than it was last year, yet our current workforce is actually 10% larger now than it was then.” Consequently, Intel will be enacting a series of painful cuts to bring the company back to profitability.

Intel is not publicly disclosing precisely where those cuts will come from, but in the company’s quarterly earnings release, the company noted that it was targeting operating expenses, capital expenditures, and costs of sales alike.

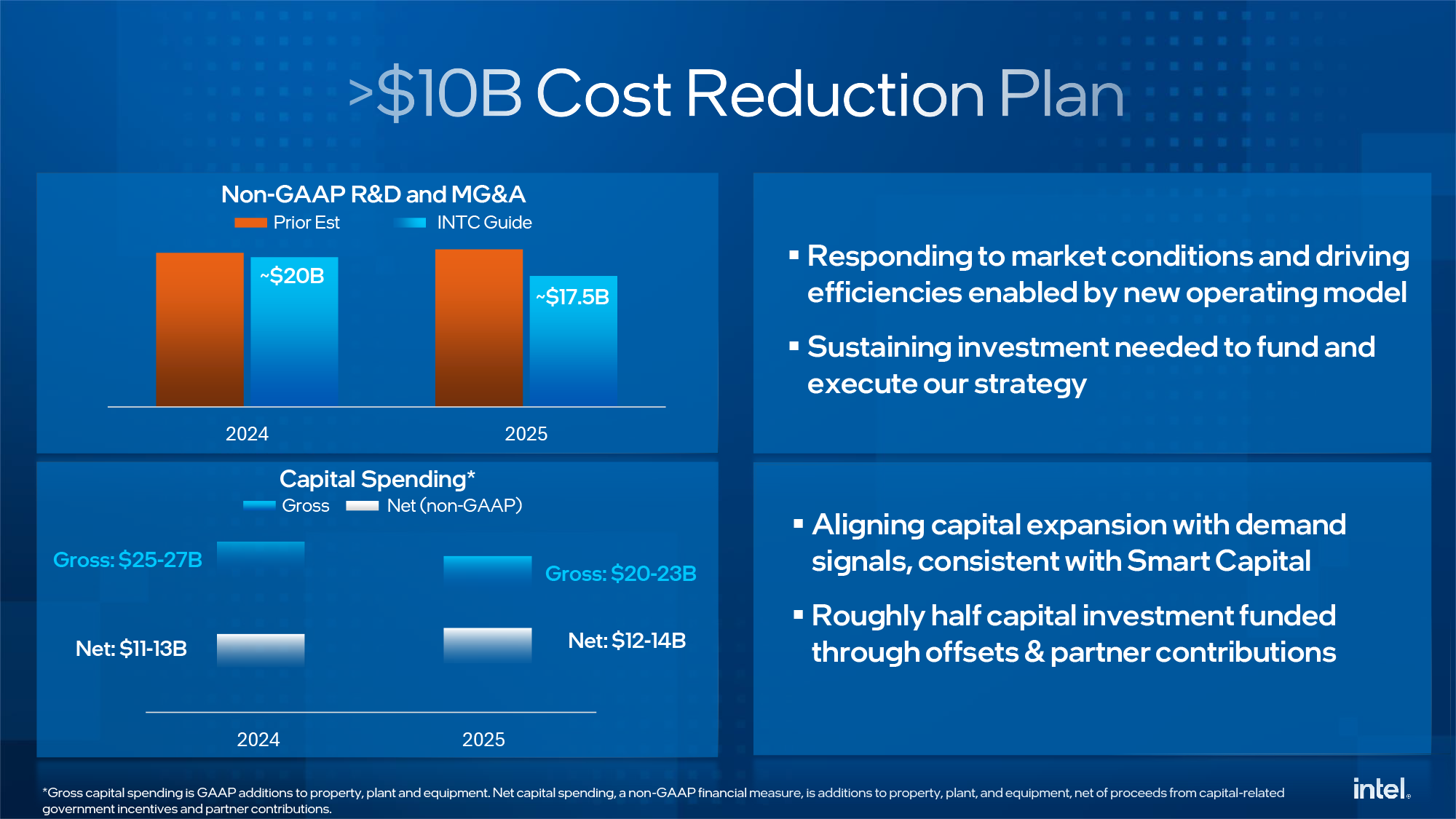

For operating expenses, Intel will be cutting “non-GAAP R&D and marketing, general and administrative” spending, with a goal to trim that from $20 billion in 2024 to $17.5 billion in 2025. Meanwhile gross capital expenditures, a significant expense for Intel in recent years as the company has built up its fab network, are projected to drop from $25 billion to $27 billion for 2024, to somewhere between $20 billion and $23 billion in 2025. Compared to Intel’s previous plans for capital expenditures, this would reduce those costs by around 20%. And finally, the company is expecting to save $1 billion on the cost of sales in 2025.

| Intel 2025 Spending Cuts | |||

| 2024 Projected Spending | 2025 Projected Spending | Projected Reduction | |

| Operating Expenses (R&D, Marketing, General, & Admin) |

$20B | $17.5B | $2.5B |

| Capital Expenditures (Gross) | $25B - $27B | $20B - $23B | $2B - $7B |

| Cost of Sales | N/A | $1B Savings | $1B |

Separately, in Intel’s email to its employees, Gelsinger outlined that these cuts will also require simplifying Intel’s product portfolio, as well as the company itself. The six key priorities for Intel will include cutting underperforming product lines, and cutting back Intel’s investment in new products to “fewer, more impactful projects”. Meanwhile on the administrative side of efforts, Intel is looking to eliminate redundancies and overlap there, as well as stopping non-essential work.

- Reducing Operational Costs: We will drive companywide operational and cost efficiencies, including the cost savings and head count reductions mentioned above.

- Simplifying Our Portfolio: We will complete actions this month to simplify our businesses. Each business unit is conducting a portfolio review and identifying underperforming products. We are also integrating key software assets into our business units so we accelerate our shift to systems-based solutions. And we will narrow our incubation focus on fewer, more impactful projects.

- Eliminating Complexity: We will reduce layers, eliminate overlapping areas of responsibility, stop non-essential work, and foster a culture of greater ownership and accountability. For example, we will consolidate Customer Success into the Sales, Marketing and Communications Group to streamline our go-to-market motions.

- Reducing Capital and Other Costs: With the completion of our historic five-nodes-in-four-years roadmap clearly in sight, we will review all active projects and equipment so we begin to shift our focus toward capital efficiency and more normalized spending levels. This will reduce our 2024 capital expenditures by more than 20%, and we plan to reduce our non-variable cost of goods sold by roughly $1 billion in 2025.

- Suspending Our Dividend: We will suspend our stock dividend beginning next quarter to prioritize investments in the business and drive more sustained profitability.

- Maintaining Growth Investments: Our IDM2.0 strategy is unchanged. Having fought hard to reestablish our innovation engine, we will maintain the key investments in our process technology and core product leadership.

The bulk of these cuts, in turn, will eventually come down to layoffs. As previously noted, Intel is planning to cut about 15% of its workforce. Just how many layoffs this will entail remains to be seen; Gelsinger’s letter puts it at roughly 15,000 employees, while Intel’s most recent published headcount would put this figure at closer to 17,000 employees.

Whatever the number, Intel is expecting to have most of the reductions completed by the end of this year. The company will be using a combination of early retirement packages and buy-outs, or what the company terms as “an application program for voluntary departures.”

Intel’s investors will be taking a hit, as well. The company’s generous quarterly dividend, a long-time staple of the chipmarker and one of the key tools to entice long-term investors, will be suspended starting in Q4 of 2024. With Intel losing money over multiple quarters, Intel cannot afford (or at least, cannot justify) paying out cash in the forms of dividends when that money could be getting invested in the company itself. Though as the long-term health of the company is still reliant on offering dividends, Intel says that the suspension will be temporary, as the company reiterated its “long-term commitment to a competitive dividend as cash flows improve to sustainably higher levels.” For Q2 2024, Intel paid out $0.125/share in dividends, or a total of roughly $0.5B.

Ultimately, the message coming from Intel today is that it is continuing (if not accelerating) its plans to slim down the company; to focus on a few areas of core competencies that suit the company’s abilities and its financial goals. Intel is throwing everything behind its IDM 2.0 initiative to regain process leadership and serve as a world-class contract foundry, and even with Intel’s planned spending cuts for 2025, that initiative will continue to move forward as planned.

On that note, cheering up investors in what’s otherwise a brutal report from the company, Intel revealed that they’ve achieved another set of key milestones with their in-development 18A process. The company released the 1.0 process design kit (PDK) to customers last month, and Intel has successfully powered-on their first Panther Lake and Clearwater Forest chips. 18A remains on track to be “manufacturing-ready” by the end of this year, with Intel looking to start wafer production in the first half of 2025. 18A remains a make-or-break technology for Intel Foundry, and the company as a whole, as this is the node that Intel expects to return them to process leadership – and from which they can improve upon to continue that leadership.

Sources: Intel Q2'24 Earnings, Intel Staff Letter

68 Comments

View All Comments

sjkpublic@gmail.com - Thursday, August 1, 2024 - link

Such great sadness. There will be college courses on how Intel Management over the course of the last few years failed miserably. Intel Management has been a total disaster.EJ42 - Thursday, August 1, 2024 - link

They just need to update their ME firmware. 🤔sjkpublic@gmail.com - Friday, August 2, 2024 - link

Its goes a bit more than that. My take is they are drowning in there own complexity to keep competitive.name99 - Friday, August 2, 2024 - link

At SOME point the lesson will be understood that you either weed away some of the complexity every year (or every few years) [like Apple or ARM], or you sell perpetual compatibility (which means ever large complexity) till the point that you fail as a business (Intel? Microsoft?).Real problem is that the people setting strategy see the immediate costs of retaining compatibility just one more year, but not the costs of that retention over the next decade and more. Until this is understood...

Threska - Friday, August 2, 2024 - link

The important thing with compatibility is getting those that need it to pay for it.Strunf - Tuesday, August 6, 2024 - link

All of them are becoming more complex Intel, Apple, there's no way around it. Number of transistors keeps increasing...flgt - Friday, August 2, 2024 - link

The die had been cast by the time Pat got there. There was no way they were going to let Intel get rid of the fabs and leave the west with no leading edge technology. It’s all in on the Fab at this point. The governments who let industry ship everything to Asia are going to have to pay up now to keep Intel from folding.sjkpublic@gmail.com - Friday, August 2, 2024 - link

Big failure on the fabs. Bug failure on trying to keep competitive through the microcode and power performance and efficiency. One has to realize that the support cost of coding. And microcode coding is very costly to support. KISS - keep it simple... That is one of the nice things about ARM.powerarmour - Saturday, August 3, 2024 - link

Staggering that Pat G got a raise when he's responsible for this mess. Reliability and customer confidence are in the toilet.MarcusMo - Saturday, August 10, 2024 - link

Gelsinger is not responsible for this. Companies do as big as Intel do not turn on a dime. Thats why the quarterly economics are so harmful for longterm value. Be aware that your comment plays into that notion.